by Kevin Cody

Current and past political leaders are taking opposing positions on a November 5 ballot measure that would increase Hermosa’s sales tax revenue by $3 million annually.

In February, the City Council voted, four to one, to ask voter approval of a 3/4% Transaction and Use Tax (TUT or sales tax). Council Dean Francois cast the dissenting vote.

The ballot argument in favor of the sales tax increase has been signed by Councilmembers Justin Massey, and Rob Saeman, School Boardmember Maggie Bove-Lamonica, Police Chief Paul LeBaron and former Councilmember George Schmeltzer (1976-84). Schmeltzer is the only proponent signor who no longer holds an official city title.

Five former councilmembers have signed the ballot argument opposing the measure. They are Carolyn Petty (2013-17), Sam Edgerton (1992-07), JR Reviczky (1993-09), Jim Rosenberger (1986-89), and Michael Keegan (2001-09).

A second opposition ballot argument has been submitted by Keegan, who is seeking reelection to the council in November, and Elka Worner, a first time candidate for council.

Proponents of the sales tax increase argue the sales tax increase is needed to balance the city budget without reducing city services.

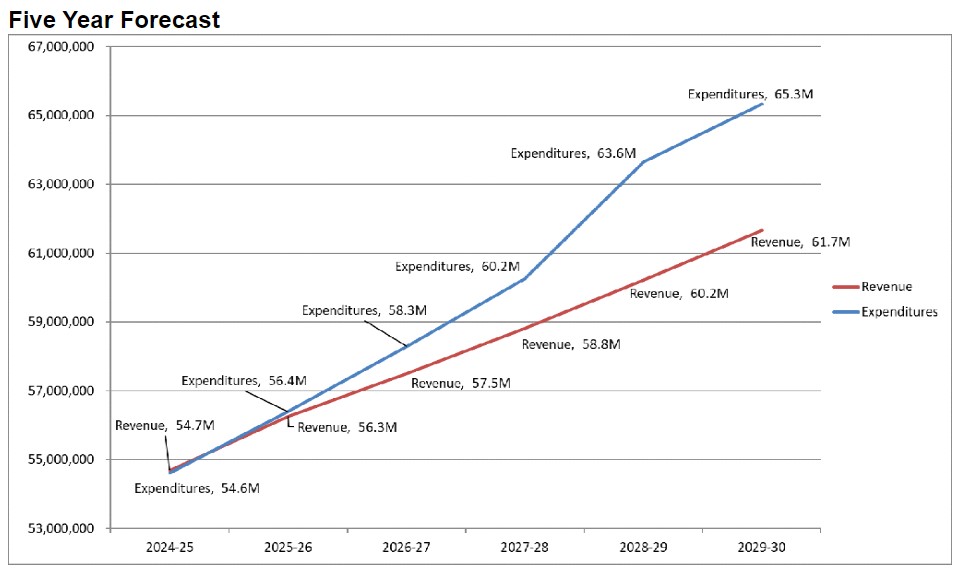

The city balanced its $54 million budget this year, but projects rising deficits, reaching $3.6 million by the end of the decade.

All of the sales tax increase from the proposed ballot measure would go to Hermosa’s general fund, the proponents argue. Additionally, they note, approximately half of the increased sales tax would be paid by Hermosa’s 5.2 million annual visitors.

The opposition argument by the former council members blames Hermosa’s financial shortfall on unnecessary spending, not revenue shortfalls. Increased property and hotel taxes have increased city revenues over the past six years from $45 million to a projected $54 million this year.

Their argument further notes that voters rejected a similar tax increase on the 2022 ballot.

Candidates Keegan’s and Worner’s argument contend the sales tax increase will hurt local businesses.

Additionally, they argue, “There is no guarantee that the $3 million won’t go to higher salaries and bonuses.” ER