by Kevin Cody

Hermosa Beach Finance Director Viki Copeland presented what she described as a “tightly balanced” budget to the City Council at its Tuesday, June 11 meeting.

General fund revenue for 2024-25 is projected to be $54.3 million, up three percent from the preceding fiscal year. Expenditures are projected to be $52.8 million, up four percent from the preceding fiscal year.

Over the past three years, Copeland said in her report to the council, the city has balanced similarly tight budgets with $4.3 million in American Rescue Plan Act (ARPA) funds. The coming year’s balance budget was achieved despite not having ARPA funds, and without reliance on contingency, or “rainy day,” funds.

The council was unanimous in its praise for Copeland, City Manager Suja Lowenthal and the city staff for their work on the budget, which they unanimously approved.

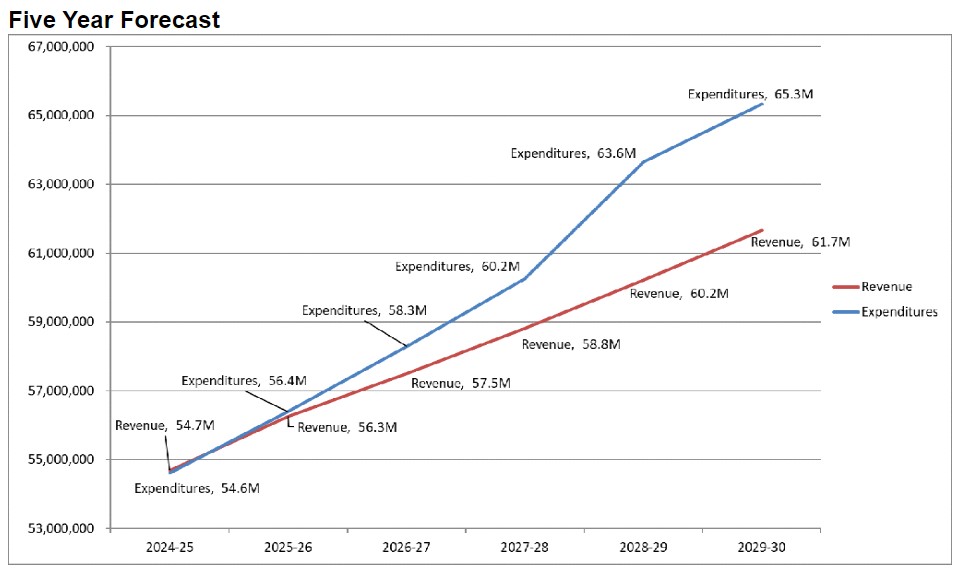

But Copeland projected the budget will become tighter in coming years unless the city increases revenue.

“Fiscal year 2025-26 has a shortfall of $144,726. The shortfall in 2029-30 would be significant, at $3.6 million.”

“…avoiding a deficit in two years will be challenging with Los Angeles County Fire negotiations, labor negotiations and increasing pension costs pending,” Copeland wrote in her report. Hermosa will pay $8.5 million in the coming year for County Fire Department services. But that number is expected to increase by $1.5 million after the current contract expires in December 2027, Copeland wrote in her budget report.

In February, in an effort to avert pending deficits, the council unanimously approved placing a 3/4% sales tax increase on the upcoming November ballot. If approved, the increase would generate an estimated $3 million annually for the city. The revenue would nearly double the $3.8 million in sales tax the city estimates for the coming fiscal year.

The overall budget approved by the council Tuesday night is $94 million. It includes $28 million in capital improvements, largely for street improvements ($3 million), sewer and storm drain improvements ($870,000), and building and grounds improvements ($5 million).

Property taxes, the city’s largest source of general fund revenue, at 37 percent, is projected to reach $20.3 million, a 4% increase, or nearly $1 million over the 2023-24 fiscal year.

Sales tax revenue is projected to decrease by 2% from the last fiscal year, to $3.8 million.

Bars and restaurants are the largest sales tax generators, at 31%.

Hermosa’s Transient Occupancy Tax (TOT), or hotel bed tax, is expected to decline by 1%, to $5.1 million due to declining occupancy rates. Included in the TOT revenue are seven short term rental properties, which are legal only in commercial districts.

The 6% Utility Users Tax, on electricity, water, gas, and cable and the 5.5% UUT phones, are projected to stay constant at $2.7 million. It represents 5% of the general fund.

The general fund will get a boost in revenue from increases in parking fees approved by the council last year.

Residential Parking Permits are projected to increase by $52,000. Parking meters rates, which the council increased last December, from $1.50 per hour to $2.50 per hour, are projected to bring in an additional $1.15 million next year. ER